2021年 フレンズプロビデント(FPI)ファンドランキング

ファンドランキング-1024x576.jpg)

今年も早いもので年の瀬となりました。2020年3月のコロナショックを皮切りに実体経済とは裏腹に株式市場は鰻登りとなり現在に至ります。ほんと新型コロナウィルス一色の1年だった気がします。ニュースを見てもコロナ、話す内容もコロナと、メディアの影響力の高さには驚かされますね。年末にはオミクロン株、中国恒大グループのデフォルトなどマーケットを左右するようなトピックがありしたが、一旦は落ち着きを見せている気がします。年間を通してコロナ一色だった2021年でしたが、どのファンドが優秀だったのか結果発表していきたいと思います。

2021年の優秀ファンド順データ

※Morningstar2021年12月30日時点のデータを元に作成しました。

| 順位 | ファンド名 | ファンドコード | 2022年損益 |

| 1 | L82 Kotak India MidcapD | L82 | 35.32 |

| 2 | R09 JPM Taiwan | R09 | 32.98 |

| 3 | P02 Vanguard US 500 Stock IndexD,J | P02 | 28.55 |

| 4 | L38 Schroder Frontier Markets EquityW | L38 | 28.08 |

| 5 | M85 Invesco Global OpportunitiesD | M85 | 26.32 |

| 6 | L44 Emirates NBD MENA Top CompaniesD,V,W,X,Y | L44 | 25.86 |

| 7 | P59 HSBC Islamic Global Equity IndexD | P59 | 25.74 |

| 8 | L47 Fidelity America | L47 | 24.88 |

| 9 | J77 BlackRock US Flexible Equity | J77 | 24.82 |

| 10 | R52 Schroder Middle East | R52 | 24.31 |

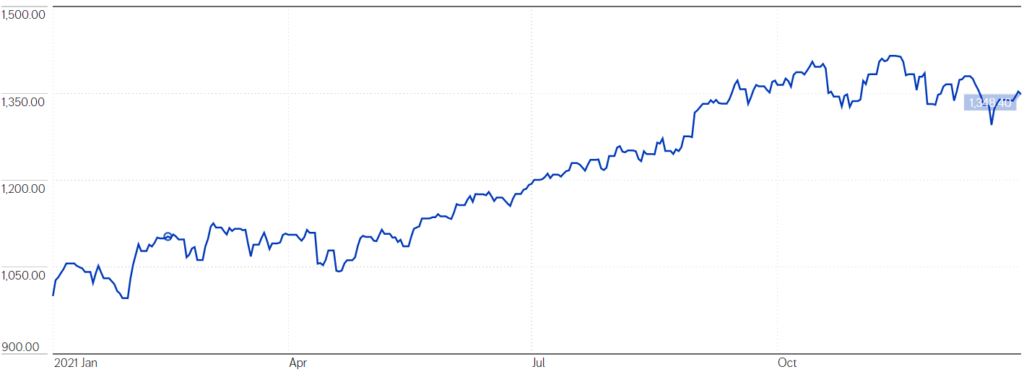

ランキング1位 L82 Kotak India Midcap

ランキング1位に輝いたのはインドのファンドとなりました!年末若干失速したものの安定した右肩上がり運用となり利回りは驚異の35%超えとなりました。

構成ファンドはファンド名の通りインド株式が中心となり、上位10社は下記の通りです。インド株式強いですね。来年も注目していきましょう。

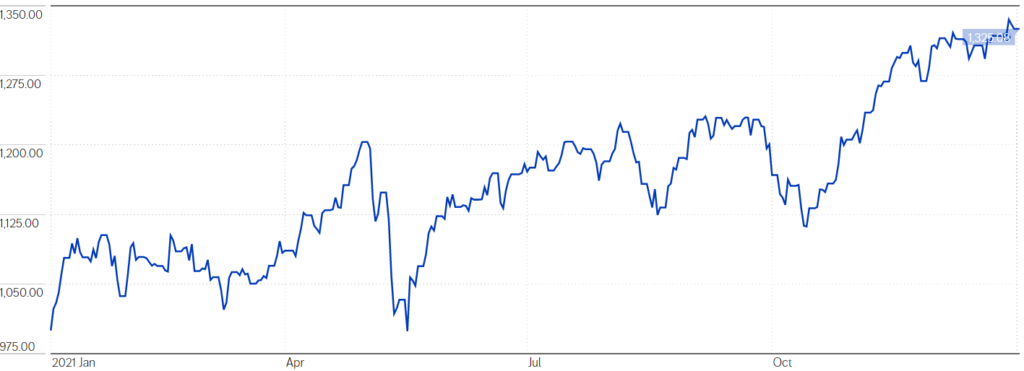

ランキング2位 JPM Taiwan

こちらのファンドも利回りは30%超えとなりました。個人年金保険のように必ず増えるという確約はありませんが、ここまで増える可能性があるというのは魅力的ですね。1位のファンドに比べると変動幅が大きく不安定ではありますが、9月後半の伸びは物凄いですね。

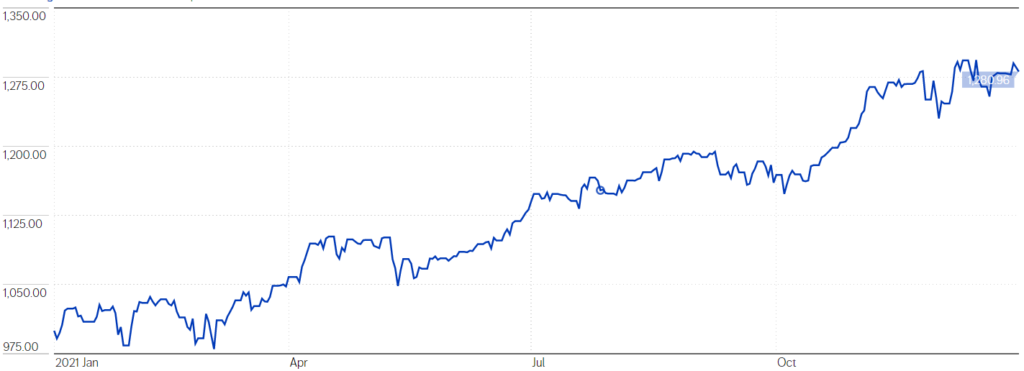

ランキング3位 Vanguard US 500 Stock Index

右肩上がりし続けるSP500ですが、なんだかんだ今年も上位に食い込む結果となりました。そろそろ下落するか?という局面は何度かありましたが、底が厚く反発しては上昇を繰り返してきました。来年はどのような動きをするのか楽しみですね。

| 11 | P84 Schroder Global Cities (GBP)D | P84 | 24.29 |

| 12 | P66 JPMorgan Asian Smaller CompaniesV,X | P66 | 24.12 |

| 13 | P82 Schroder Global Cities (USD)F | P82 | 23.61 |

| 14 | P63 Janus Henderson Horizon European Growth (USD)D | P63 | 23.34 |

| 15 | L12 Fidelity EMEA | L12 | 22.9 |

| 16 | L81 Kotak India GrowthD | L81 | 21.87 |

| 17 | L19 JPM Global Natural Resources | L19 | 21.62 |

| 18 | J39 Schroder US Smaller Companies | J39 | 21.6 |

| 19 | P80 Fidelity Global Property (GBP)D | P80 | 20.06 |

| 20 | P78 Fidelity Global Property (USD)F | P78 | 20.05 |

| 21 | J74 Ninety One GS Global Strategic Equity | J74 | 19.94 |

| 22 | L77 Blackrock SF – Managed Index Portfolios Growth (USD)D | L77 | 19.25 |

| 23 | R33 Schroder Global Equity Yield (EUR) | R33 | 19.24 |

| 24 | J30 JPMorgan IndiaV,X | J30 | 19.22 |

| 25 | R32 Schroder Global Equity Yield (USD) | R32 | 18.57 |

| 26 | L69 Schroder ISF Global Equity YieldD | L69 | 18.42 |

| 27 | L14 HSBC Russia Equity | L14 | 18.18 |

| 28 | J06 Ninety One GS Global Equity | J06 | 17.87 |

| 29 | L74 Blackrock SF – Managed Index Portfolios Growth (GBP)D | L74 | 17.33 |

| 30 | J11 FPIL UK Index TrackerD | J11 | 16.64 |

| 31 | L42 Natixis Harris Associates Global EquityY | L42 | 16.56 |

| 32 | J76 Principal European Equity | J76 | 16.54 |

| 33 | P70 BlackRock World Mining | P70 | 16.53 |

| 34 | R12 DWS Invest Global AgribusinessD | R12 | 16.42 |

| 35 | L21 Pictet Global Environmental OpportunitiesA | L21 | 16.39 |

| 36 | P54 Aberdeen Standard SICAV I – Indian Equity | P54 | 16.05 |

| 37 | P69 BlackRock Sustainable Energy | P69 | 15.75 |

| 38 | L40 Invesco Continental European Small Cap Equity | L40 | 14.67 |

| 39 | R11 Aberdeen Standard SICAV I – Emerging Markets Smaller Companies | R11 | 14.36 |

| 40 | L71 Fidelity Global Focus (GBP)D | L71 | 14.15 |

| 41 | L83 BlackRock United Kingdom (GBP)U | L83 | 13.22 |

| 42 | M87 Invesco Global Small Cap Equity | M87 | 13.05 |

| 43 | P83 Schroder Global Cities (EUR)F | P83 | 13.03 |

| 44 | M56 Barings Australia | M56 | 12.59 |

| 45 | L76 Blackrock SF – Managed Index Portfolios Moderate (USD)D | L76 | 12.51 |

| 46 | J57 Invesco Global Health Care Innovation | J57 | 12.46 |

| 47 | J36 Ninety One GS European Equity | J36 | 11.44 |

| 48 | R92 Emirates NBD Islamic Global BalancedD,V,X,Y | R92 | 11.27 |

| 49 | L46 Fidelity Global Dividend | L46 | 11.04 |

| 50 | L73 Blackrock SF – Managed Index Portfolios Moderate (GBP)D | L73 | 10.91 |

| 51 | L18 JPM Global Growth | L18 | 10.71 |

| 52 | R34 Schroder Global Climate Change Equity | R34 | 10.55 |

| 53 | S235 Harmony Portfolios US Dollar GrowthD | S235 | 10.4 |

| 54 | P51 Franklin Mutual European | P51 | 10.35 |

| 55 | L66 Quilter Investors Compass 4 Portfolio (USD)D | L66 | 10.25 |

| 56 | P17 CGWM AffinityD | P17 | 9.16 |

| 57 | S237 Harmony Portfolios Sterling GrowthD | S237 | 9.01 |

| 58 | R95 Emirates NBD Active ManagedD,V,X,Y | R95 | 8.55 |

| 59 | L67 Quilter Investors Compass 4 Portfolio (GBP HDG)D | L67 | 8.47 |

| 60 | P18 CGWM OpportunityD | P18 | 8.36 |

| 61 | J84 Fidelity Sustainable Europe Equity | J84 | 7.88 |

| 62 | L26 Alquity AfricaW | L26 | 7.56 |

| 63 | P14 CGWM Affinity (GBP)D | P14 | 7.34 |

| 64 | R61 JPM Emerging Markets Small CapD,W | R61 | 7.2 |

| 65 | L68 Quilter Investors Compass 4 Portfolio (SGD HDG)D | L68 | 6.83 |

| 66 | S234 Harmony Portfolios US Dollar BalancedD | S234 | 6.55 |

| 67 | P15 CGWM Opportunity (GBP)D | P15 | 6.47 |

| 68 | S236 Harmony Portfolios Sterling BalancedD | S236 | 6.29 |

| 69 | L63 Quilter Investors Compass 3 Portfolio (USD)D | L63 | 6.21 |

| 70 | L35 Mellon Global Real ReturnD | L35 | 6.11 |

| 71 | J27 Barings Developed and Emerging Markets High Yield Bond Fund | J27 | 6 |

| 72 | S131 GAM Star Global Growth (USD)D | S131 | 5.5 |

| 73 | R08 JPMorgan ASEANV,X | R08 | 5.28 |

| 74 | P16 CGWM DiversityD | P16 | 5.24 |

| 75 | P48 Barings Eastern Europe | P48 | 5.23 |

| 76 | R91 Fidelity Multi Asset Open Strategic (GBP)D | R91 | 5.16 |

| 77 | S262 Harmony Portfolios Europe GrowthD | S262 | 4.87 |

| 78 | S128 GAM Star Global Balanced (USD)D | S128 | 4.72 |

| 79 | R63 Allianz Japan Equity | R63 | 4.7 |

| 80 | R94 Emirates NBD Balanced ManagedD,V,X,Y | R94 | 4.6 |

| 81 | L41 Schroder Global Multi-Asset Income (USD) | L41 | 4.46 |

| 82 | L64 Quilter Investors Compass 3 Portfolio (GBP HDG)D | L64 | 4.41 |

| 83 | P41 Ninety One Global Income OpportunitiesD | P41 | 4.26 |

| 84 | S130 GAM Star Global Growth (GBP)D | S130 | 4.13 |

| 85 | L22 PIMCO Global Real ReturnD | L22 | 4.12 |

| 86 | L75 Blackrock SF – Managed Index Portfolios Defensive (USD)D | L75 | 3.9 |

| 87 | S125 GAM Star Global Cautious (USD)D | S125 | 3.61 |

| 88 | P13 CGWM Diversity (GBP)D | P13 | 3.52 |

| 89 | R27 Fidelity Global Multi-Asset Growth & Income (EUR)D | R27 | 3.28 |

| 90 | S261 Harmony Portfolios Asian GrowthD | S261 | 3.27 |

| 91 | S112 Jupiter Financial Innovation | S112 | 3.27 |

| 92 | L65 Quilter Investors Compass 3 Portfolio (SGD HDG)D | L65 | 3.27 |

| 93 | S127 GAM Star Global Balanced (GBP)D | S127 | 3.23 |

| 94 | R26 Fidelity Global Multi-Asset Growth & Income (USD)D | R26 | 3.2 |

| 95 | P40 Value Partners High-Dividend StocksV,W,X | P40 | 3.04 |

| 96 | J96 FPIL Aberdeen Standard SICAV I – Global Innovation Equity | J96 | 3.03 |

| 97 | L37 Schroder Global Multi-Asset Income (GBP HDG) | L37 | 2.78 |

| 98 | L43 Emirates NBD MENA Fixed IncomeD,V,X,Y | L43 | 2.78 |

| 99 | L33 PIMCO Global High Yield Bond | L33 | 2.65 |

| 100 | L72 Blackrock SF – Managed Index Portfolios Defensive (GBP)D | L72 | 2.47 |

| 101 | S124 GAM Star Global Cautious (GBP)D | S124 | 2.14 |

| 102 | R62 Allianz GEM Equity High Dividend | R62 | 1.81 |

| 103 | P56 BlackRock Japan Opportunities | P56 | 1.8 |

| 104 | R93 Emirates NBD Global Quarterly IncomeD,V,X,Y | R93 | 1.73 |

| 105 | R16 FPIL EuropeanD | R16 | 1 |

| 106 | S260 Harmony Portfolios Asian BalancedD | S260 | 0.81 |

| 107 | P61 Janus Henderson Horizon Asia-Pacific Property IncomeF,W | P61 | 0.79 |

| 108 | R31 FSSA Greater China Growth | R31 | 0.79 |

| 109 | J47 JPMorgan ThailandV,X | J47 | 0.69 |

| 110 | R30 FSSA Asian Equity Plus | R30 | 0.63 |

| 111 | J43 Ninety One GS Global Multi-Asset Income | J43 | 0.6 |

| 112 | J71 Schroder Japanese Opportunities | J71 | 0.23 |

| 113 | R82 Ninety One Multi Asset ProtectorD | R82 | 0.21 |

| 114 | J38 Invesco Emerging Markets Equity | J38 | 0.07 |

| 115 | J42 JPM USD Money Market VNAV | J42 | 0.03 |

| 116 | J46 Barings Korea FeederX | J46 | 0.02 |

| 117 | L60 Fidelity US Dollar Cash FundD | L60 | -0.26 |

| 118 | L45 Invesco India Bond | L45 | -0.31 |

| 119 | J02 Invesco Asian Equity | J02 | -0.41 |

| 120 | M66 Ninety One GS US Dollar Money | M66 | -0.44 |

| 121 | J32 JPMorgan Pacific SecuritiesV,X | J32 | -0.68 |

| 122 | P92 Schroder Strategic Bond (USD)D | P92 | -0.85 |

| 123 | P90 Schroder Global Corporate Bond (USD) | P90 | -1.03 |

| 124 | L48 Invesco Global Targeted Returns (USD HDG)D | L48 | -1.24 |

| 125 | M65 Ninety One GS Sterling Money | M65 | -1.79 |

| 126 | L59 Fidelity Sterling Cash FundD | L59 | -1.93 |

| 127 | J03 Barings Asia Growth | J03 | -2.52 |

| 128 | P75 Invesco Sterling BondD | P75 | -2.59 |

| 129 | S132 GAM Star Global Growth (EUR)D | S132 | -3.12 |

| 130 | M83 Schroder Asian Bond Total Return | M83 | -3.25 |

| 131 | R86 Amundi Volatility WorldD,W | R86 | -3.78 |

| 132 | S129 GAM Star Global Balanced (EUR)D | S129 | -3.87 |

| 133 | R97 Templeton Asian Bond | R97 | -4.12 |

| 134 | J48 Allianz Emerging Asia Equity | J48 | -4.17 |

| 135 | P65 Aberdeen Standard SICAV I – Asia Pacific Equity | P65 | -4.57 |

| 136 | L29 Pictet CH Precious Metals – Physical GoldD,V,X | L29 | -4.73 |

| 137 | L06 Templeton Global Bond (USD) | L06 | -4.84 |

| 138 | L05 Templeton Global Bond (EUR) | L05 | -4.91 |

| 139 | S126 GAM Star Global Cautious (EUR)D | S126 | -4.92 |

| 140 | J01 Invesco BondD | J01 | -4.96 |

| 141 | P58 Templeton BRIC | P58 | -5.09 |

| 142 | L04 Templeton Global Total Return (USD)D | L04 | -5.15 |

| 143 | L03 Templeton Global Total Return (EUR)D | L03 | -5.19 |

| 144 | J60 Templeton Emerging Markets | J60 | -6.14 |

| 145 | L13 Templeton Emerging Markets Bond | L13 | -6.9 |

| 146 | R51 FSSA China Growth | R51 | -7.12 |

| 147 | P67 Mellon Global Bond (USD) | P67 | -7.86 |

| 148 | R70 Mellon Global Bond (GBP)D | R70 | -7.94 |

| 149 | P74 Invesco Euro Corporate BondD | P74 | -7.98 |

| 150 | L62 Fidelity Euro Cash FundD | L62 | -8.29 |

| 151 | J34 JPMorgan Asia GrowthV,X | J34 | -8.96 |

| 152 | J87 Fidelity Euro Bond | J87 | -9.53 |

| 153 | P87 Barings Global Bond (EUR) | P87 | -9.54 |

| 154 | M57 Barings Global Bond (USD) | M57 | -9.8 |

| 155 | M82 BlackRock World Gold | M82 | -11.53 |

| 156 | R44 Allianz Total Return Asian Equity | R44 | -11.56 |

| 157 | J95 JPMorgan Pacific TechnologyV,X | J95 | -12.22 |

| 158 | J37 Schroder Latin American | J37 | -12.57 |

| 159 | R69 DWS Noor Precious Metals SecuritiesD | R69 | -13.34 |

| 160 | P52 Templeton Latin America | P52 | -14.23 |

| 161 | R25 Invesco Asia Opportunities Equity | R25 | -15.81 |

| 162 | P33 Aberdeen Standard SICAV I All China Equity | P33 | -16.47 |

| 163 | L39 Franklin Biotechnology Discovery | L39 | -16.57 |

| 164 | M55 Barings Hong Kong & China | M55 | -17.69 |

| 165 | J56 HSBC Hong Kong Equity | J56 | -18.05 |

| 166 | R98 Janus Henderson Horizon China OpportunitiesD,W | R98 | -20.87 |

| 167 | J55 HSBC Chinese Equity | J55 | -21.95 |

| 168 | L51 Value Partners Greater China High Yield IncomeV,X,Ac | L51 | -22.5 |

| 169 | P89 BNP Paribas Brazil Equity | P89 | -24.08 |

| 170 | L36 JPMorgan IndonesiaV,X | L36 | – |

| 171 | L85 Fidelity US Dollar BondU | L85 | – |

| 172 | L86 JPMorgan India Smaller Companies (USD)D,V,X | L86 | – |

| 173 | L87 Fundsmith Equity (GBP)D,U | L87 | – |

| 174 | L84 BlackRock Emerging Markets Corporate Bond (USD)U | L84 | – |

| 175 | L88 Ninety One Global Environment USDD,U | L88 | – |

| 176 | L89 HSBC Global Equity Climate Change USDD,U | L89 | – |

| 177 | L90 Pictet Timber USDD,U | L90 | – |

| 178 | L91 RobecoSAM Smart Energy USDD,U | L91 | – |

| 179 | L92 Schroder Global Sustainable Growth USDD,U | L92 | – |

| 180 | L93 AB Sustainable Global Thematic USDD,U | L93 | – |

| 181 | L94 BMO Responsible Global Equity GBPD,U | L94 | – |

| 182 | L95 JPM Socially Responsible USDD,U | L95 | – |

| 183 | L96 RobecoSAM Sustainable Water USDD,U | L96 | – |

| 184 | L97 RobecoSAM Sustainable Healthy Living Equities USDD,U | L97 | – |

| 185 | L98 RobecoSAM Global Gender Equality Equities USDD,U | L98 | – |

皆さんは上位に入っているファンドをご自身のポートフォリオに組み込むことができていましたでしょうか?2022年もしっかり予測して勝てるファンドを選んでいきましょう!